103rd Legislature, March-October 2025: We (Finally) Have a Budget

Advocates and agency staff alike made numerous visits to Lansing over the past six months to talk transit investment. There was no shortage of marketing goodies during March's Transit Day at the Capitol 🚌

I hadn't planned to lump six months of legislative activity into a single article but hey, better late than never right? Times have been busy, folks 😅

The usual disclaimer applies: This article was written on my own time. Coverage of legislative activity on this blog represents my independent views and analysis unless otherwise noted.

You may also be interested in last year's budget breakdown and lame duck recap .

FY 2025-26 Fiscal Agency Summaries

House Fiscal Agency Budget Summary

Senate Fiscal Agency Budget Summary

Local Bus Operations (LBO) Funding

Final Conference Budget

| Funding Type | FY 24-25 Enacted Budget | FY 25-26 Executive Proposal | FY 25-26 Legislative Proposal |

|---|---|---|---|

| Sustained | $226.7M | +$0M (Unchanged) | +$44.8M |

| One-Time | $20M (ARPA) | Not Renewed | Not Renewed |

| Total (Combined) | $246.7M | $226.7M | $271.6M |

In terms of absolute dollar amount, the $44.8M increase to $271.6M marks an all-time high for LBO funding . As American Rescue Plan Act (ARPA) funds have been exhausted, the entirety of this funding is now a sustained allocation. $42.4M of the increase is sourced from revenue generated by the Transportation Funding Package – more on that in the next section – and the remaining $2.4M is shifted from transit capital investment funds.

Additionally, due to provisions in the Transportation Funding Package, this record funding now represents a funding floor. Michigan's Comprehensive Transportation Fund (CTF), from which LBO dollars are sourced, will be increased by $35M annually through FY2029-30. This amount will further rise to $52.5M annually in FY2030-31 and beyond.

Harmony Lloyd, MPTA Board President, and John Dulmes, MPTA Executive Director, address the House Appropriations Subcommittee on State and Local Transportation on May 21st. ( View recording )

Per the Michigan Public Transit Association's budget summary , we should see this extra $35M added to the FY2025-26 budget as well. Its exclusion was deemed a legislative oversight due to this year's less than orderly budget cycle. This could bring total LBO funding over $300M for the next fiscal year.

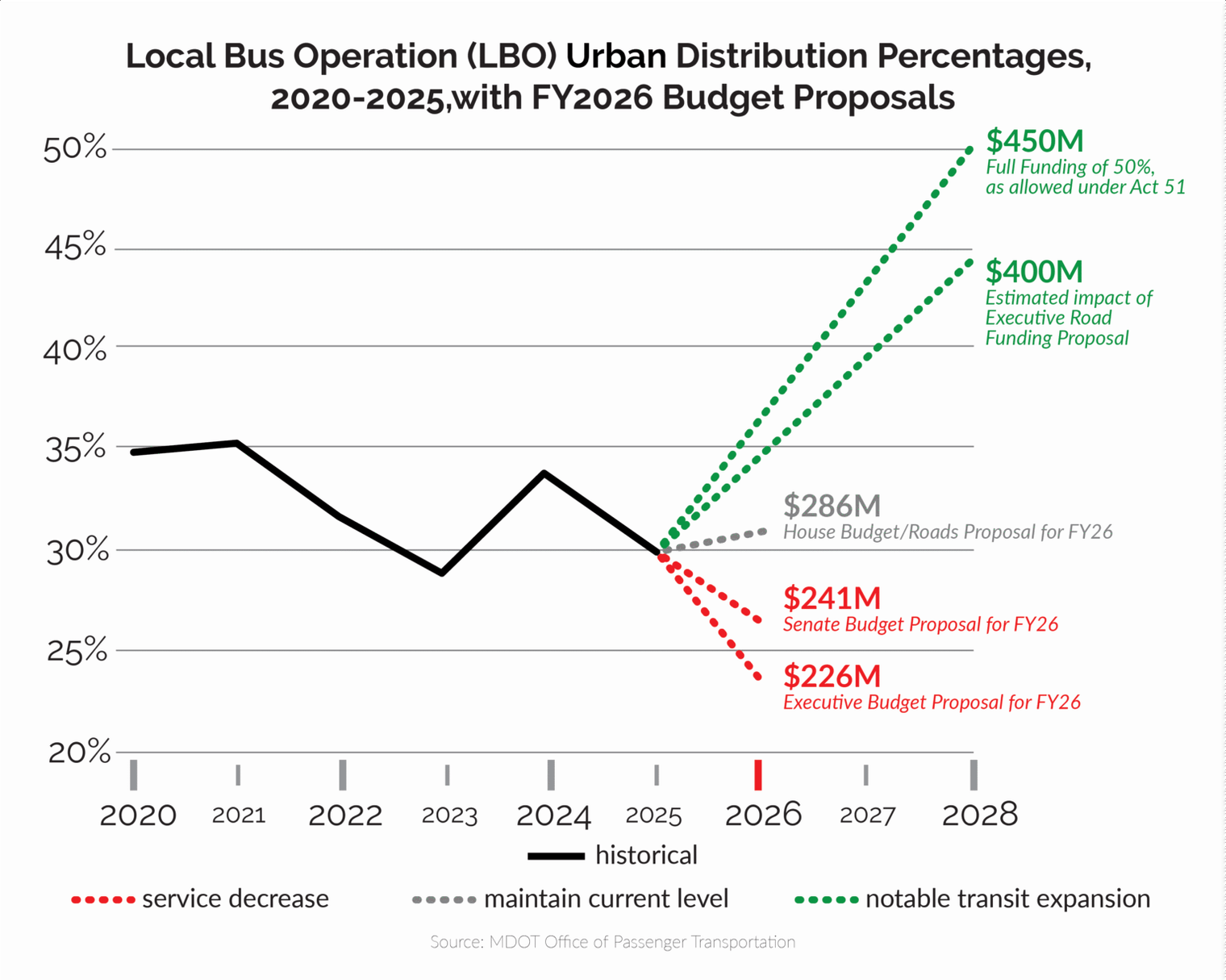

For reference: According to MDOT's Office of Passenger Transportation, fully funding LBO up to the statutory ceiling of 50% operations cost reimbursement for urban agencies would require approximately $450M.

The final budget amount of $271.6M (or over $300M, if you count the expected additional increase) places us closer to the statutory LBO ceiling than we've ever been. Note that the funding ceiling is percentage-based: The exact dollar amount fluctuates with each overall state transportation budget.

(Chart credit: Transportation Riders United , data from MDOT's Office of Passenger Transportation )

MDOT calculated $270M as the approximate "hold harmless" figure for Michigan's transit providers in light of inflation and rising operational costs from insurance coverage and higher driver wages. This budget and its provisions ensure we can stave off any potential cuts to our core local bus services in the coming years.

Now that we have multi-year, seemingly stable support for current operations with no reliance on rescue funds, our Appropriations subcommittees can finally stop focusing on crisis aversion and start planning for real investment. I'm excited for next year's conversations.

Original Senate Proposal

The Senate proposed budget, SB 174 , was passed in May. This called for increasing baseline LBO funding by $15M.

Original House Proposal

The House proposed budget, HB 4706 , was passed at the end of August. This called for increasing baseline LBO funding by $59.8M, but with a caveat: Agencies would have needed to meet Farebox Recovery Ratio (FRR) benchmarks to be eligible to draw from this additional funding.

FRR is a measure used to determine how much of an agency's operating expenses are offset by fares directly. Rural agencies would have needed to cover 6% of their operating expenses from fares, while urban agencies would have needed to cover 10%. It's unclear exactly how this metric would've been calculated for the purposes of meeting this requirement.

Together, transit agency leadership and advocates successfully educated lawmakers on the importance of removing this provision. The final conference budget still recommends that Michigan's transit agencies aim for a 6% recovery ratio, but this is no longer a requirement with legal weight.

While our state legislature absolutely has the right to hold the providers of taxpayer-funded services accountable, the suggestion that FRR should determine whether operations funds are withheld demonstrated a fundamental misunderstanding of how our public transit agencies operate. It implied an expectation that transit must strive to turn a profit rather than the true goal: Enabling independent living and maximizing access to opportunity for as many Michiganders as possible.

According to 2023 National Transit Database data , only a few urban agencies in Michigan would have been eligible to access this increase in funds: MTA (Flint), KMetro (Kalamazoo), The Rapid (Grand Rapids), CATA (Lansing), and JATA (Jackson). Depending on exact calculation inputs, TheRide (Ann Arbor) and STARS (Saginaw) would have toed the line. All other agencies are well below this cutoff by design as they operate primarily coverage-focused networks designed to serve a community need. For these agencies, the House budget proposal would've effectively been a major funding cut that resulted in service reductions.

There's nothing wrong at all with incentivizing the construction of ridership-oriented projects, such as high-capacity BRT corridors which have more potential for revenue generation. But these must be incentives for accessing additional funds, not conditions tied to the existing state subsidy that our agencies use just to keep the lights on. The final budget deal handled this the correct way.

So, to recap: the Senate recommended +$15M LBO, the House recommended +$59.8M LBO with strings, and in the end, we ended up with at least +$44.8M LBO, no strings, plus a commitment to yearly sustained increases.

The Transportation Funding Package

But wait, there's more... $65M more!

October 3, 2025 • 7:42 pm🚨HUGE WIN for Michigan transit! 🚍

We just secured a record $160 MILLION increase — the largest in state history 🙌

Thanks to relentless transit advocates, pro-transit legislators, and @GovWhitmer!

More buses 🚌 Future trains 🚆 More service ✅ More communities connected!

This extra $65M comes from the Transportation Funding Package, multiple bills which are deeply intertwined with the FY2025-26 budget.

The $95M figure appears to be the approximate annual LBO increase from the FY24-25 baseline once the full amount of additional funding takes effect in FY30 ($44.8M this year + $52.5M annually = roughly $95M). We're waiting on the official House and Senate Fiscal Agency in-depth analysis documents for the exact math.

The long-awaited plan for funding Michigan's roads came to light alongside the conference budget, and as it turns out, it underwent a last-minute transformation from a roads funding plan into a holistic transportation funding plan. This plan is comprised of multiple bills which, together, create a framework for generating the additional revenue reflected in the final FY2025-26 budget.

| Bill | Lead Sponsor | Summary |

|---|---|---|

| SB 578 | Sen. Klinefelt (D-Eastpointe) | Creates the Neighborhood Roads Fund and Infrastructure Projects Authority Fund |

| HB 4180 | Rep. Steele (R-Orion) | Exempts motor fuel from sales tax, holds School Aid Fund harmless for lost revenue |

| HB 4181 | Rep. Frisbie (R-Battle Creek) | Eliminates 6% specific fuel tax on interstate carriers |

| HB 4182 | Rep. Slagh (R-Zeeland) | Exempts motor fuel from use tax, holds School Aid Fund harmless for lost revenue |

| HB 4183 | Rep. Kunse (R-Clare) | Increases motor fuel tax from 31 to 51 cents per gallon |

| HB 4951 | Rep. Steckloff (D-Farmington Hills) | Levies 24% marijuana wholesale excise tax, directs revenue to Neighborhood Roads Fund |

| HB 4961 | Rep. Bollin (R-Brighton) | Decouples state tax law from certain federal tax provisions |

The keystone of this package is SB 578, which amends the Public Act 51 transportation budget funding formula to create two new restricted funds: The Neighborhood Roads Fund and the Infrastructure Projects Authority Fund.

The Neighborhood Roads Fund

This fund includes but is not limited to the following annually from FY2025-26 through FY2029-30:

- $100M to the Local Bridge Advisory Board for critical bridge maintenance

- $40M to the Local Grade Separation Fund

- $35M to the CTF

- 5% ($1.75M) reserved for urban providers serving 10,000 people or less and rural providers

- $65M to the Infrastructure Projects Authority Fund

This fund includes but is not limited to the following annually following annually after FY2029-30:

- $10M to the Local Grade Separation Fund

- $52.5M to the CTF

- 5% ($2.63M) reserved for urban providers serving 10,000 people or less and rural providers

- $17.5M to the Infrastructure Projects Authority Fund

An incredibly oversimplified explanation of MDOT's annual budget, as regulated by Act 51:

- The primary source of funding is the Michigan Transportation Fund (MTF). Up to a statutory maximum of 10% of this fund may be distributed to the CTF each year.

- The CTF itself has two primary revenue sources: The MTF and certain revenue from the General Sales Tax Act (the "auto-related sales tax"), which was modified by this funding package. Typically, about two-thirds of this fund goes toward LBO, though this has varied year to year. 10% of the CTF is legislatively earmarked for passenger and freight services, and a portion of the fund also supports transit capital.

The Transportation Funding Package gets us very close to that 10% ceiling in FY2025-26: $160M of the $1.8B package has been earmarked specifically for transit enhancements.

While we can expect the majority of the additional CTF dollars to be directed into LBO, some of this extra $35M / $52.5M yearly could also be used to subsidize Indian Trails expansion. A few million goes a long way – even just additional non-stop trips between city pairs would be a game changer. (Return of PM eastbound service out of Grand Rapids? I want my bus back , Trails!)

The Infrastructure Projects Authority Fund

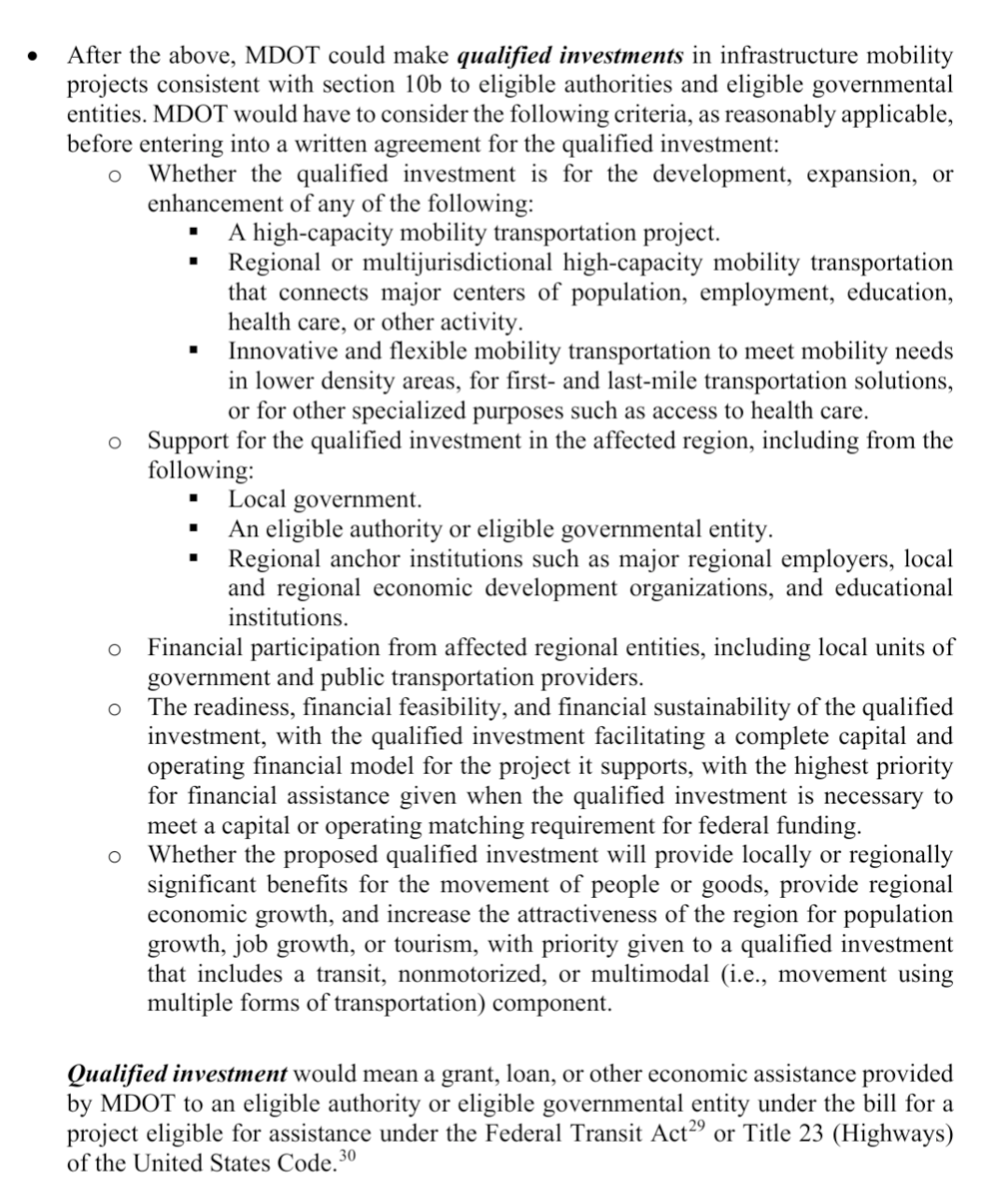

Funded by the Neighborhood Roads Fund, the Infrastructure Projects Authority Fund is dedicated to "qualified investments in infrastructure mobility projects" which meet certain criteria.

Criteria from the House Fiscal Agency summary document of the Transportation Funding Package

It's time to dream big. Similar to last year's Transformational Projects Authority proposal, the criteria for the MDOT fund highlight "high-capacity" modes of travel, which suggests rail and BRT. While this package is much smaller than last year's SOAR reform package promising $2 billion over 10 years, it's still substantial, and it's cleaner: It's no longer attached to funding failed corporate subsidy in a time of economic uncertainty.

We now have $325M in state funds over the next five years which agencies will be able to apply for, with the first project selections to be reported by December 31, 2026. This may finally be our ticket to access new federal Capital Investment Grants for full buildout of BRT corridors. Grand Rapids was first, but they need not be the last!

Some project reference points as food for thought:

- The Grand Rapids Laker Line reached a final cost of $72.8M (close to $90M adjusted for inflation) at an 80/20 split between CIG dollars and an MDOT match.

- Madison, Wisconsin's East-West BRT reached an approximate cost of $190M, with $110.6M covered in federal grants.

- The recently constructed IndyGo Purple Line reached a final cost of $188M with a 50% federal match.

- Beyond the Midwest, Seattle's RapidRide G Line reached an approximate cost of $144M, with $80M covered in federal grants.

The IndyGo Purple Line at the Fort Harrison station in Lawrence, a northeast suburb of Indianapolis. This could be us, Michigan.

As for rail, keep in mind: Frequency improvements on the Blue Water, Wolverine, and Pere Marquette already have Corridor ID funds locked in. The Detroit to Grand Rapids corridor study and the North-South Passenger Rail project are also both on track for upcoming grants, and the Midwest Interstate Passenger Rail Commission is pursuing additional federal funding which was just announced.

Think NEW services, and think regional. All-day trains between Detroit and Ann Arbor? How about Detroit to Saginaw, with the infrastructure work in Holly needed to make it possible? That's where I'd look first.

What's funding the funds?

In this deal, HB 4180 and 4812 remove the fuel tax component of the "auto-related sales tax" earmark; however, because the revenue from HB 4183's Motor Fuel Tax increase is fully directed into the MTF, the result is a net $37.5M increase in CTF funds for FY 2025-26 and a net increase of $65.6M for FY 2026-27.

All of these moving parts come together in a way which creates no visible difference to drivers at the gas pump. Marijuana wholesale price increases, however, can be expected to be passed on to the consumer.

For FY 2025-26, $3M of the revenue from the marijuana excise tax will be directed to the Comprehensive Road Funding Fund under changes made within HB 4951. The balance will be distributed to the Neighborhood Roads Fund.

For FY 2026-27 and beyond, only $500,000 will be directed to the Comprehensive Road Funding Fund, with the larger remaining balance distributed to the Neighborhood Roads Fund. Beginning with FY 2027-28, the amount allocated for funding roads will be adjusted for inflation.

For FY 2025-26, up to $688M of Corporate Income Tax revenue will be directed to the Neighborhood Roads Fund under changes made within HB 4961. This amount scales up annually to a final yearly transfer of up to $1.04B by FY2029-30.

I'm cheering along with everyone else at the news of this historic investment in new public transit projects! That said, we do have to address the elephant in the room: The process that got us here.

It's no secret that this year's budget reconciliation "process" was more of a budget reconciliation cluster. There isn't even a consensus on whether the four-hour gap between the end of the fiscal year and Governor Whitmer's signing of a weeklong Continuing Resolution at 4:18am on October 1st actually constituted a state government shutdown .

October 1, 2025 • 1:51 amLansing's collective head is exploding right now in a way I have not seen in my 27 years in and around these parts.

Even the absolute pros had no idea what was happening at 12:01am, the constitutional deadline for a budget to be enacted. (Zach Gorchow is the president of Gongwer News Service .)

On the latest episode of Off the Record (~13:42 to 17:20), several members of the Capitol press corps discussed the ramifications of the precedent which would've been set had state government continued to operate with no approved budget.

We really avoided something that could've been precedent-setting or problematic [...] And they were sitting there, staring at the idea that we're just going to keep the government open, without a budget, with the governor deciding. Think about in the future if there's a Republican legislature, Democratic governor, or vice versa, and the governor says, 'I'll veto your budget, and because of what happened in 2025, I'm just keeping the government going on what I want to do.'"

— Zoe Clark of Michigan Public and Craig Mauger of The Detroit News

We almost walked ourselves into a very serious precedent-setting issue that we managed to somehow cartwheel our way out of at the 13th hour with a stopgap bill.

— Jordyn Hermani, Bridge Michigan

Beyond that, there's the issue of transparency. Most legislative staffers and lobbyists, let alone members of the general public, did not have a clear picture of this budget until after it had been sent to Governor Whitmer's desk. The extra $160M was added to the transportation package well after its first iteration received a subcommittee hearing in March as a last-minute, seemingly overnight deal. Again, super happy it happened – just would've liked the opportunity to be in the room when it did!

Things aren't about to get prettier, either. This same divided legislature will have to produce another budget in 2026 – hopefully before June 30th this time – with every seat in the House and Senate on the ballot as well as the race for Governor Whitmer's successor. Everything will be on the line for every elected at the negotiating table, so... strap in. It's gonna get bumpy.

Supplemental Transit-Related Appropriations

Every year, Community Enhancement Grants are awarded from the General Fund. This year's grants included:

- $1M for the continued operation of Durand Union Station's railroad museum

- $1M to Washtenaw County for road improvements

Two additional Critical Infrastructure Projects received supplemental appropriations funding:

- $750K to Van Buren Township for intersection safety improvements

- $5M to Wayne County for a rail grade separation project

Supplemental Transit-Related Earmarks

Other miscellaneous transportation-related projects across Michigan which received dedicated funding include but are not limited to the following:

| Lead Sponsor | Amount | Recipient | Purpose |

|---|---|---|---|

| Rep. Wilson Jr. (D-Ypsilanti) | $3M | Ypsilanti DDA | Reconstruction of Cross Street Bridge |

| Sen. Camilleri (D-Trenton) | $10M | Wayne County DPS | Reconstruction of West Road Bridge |

| Sen. Polehanki (D-Livonia) | $1M | Livonia | Construction of multiuse path on Stark Road over I-96 |

| Sen. Shink (D-Northfield Township) | $1M | Huron-Waterloo Pathways Initiative | Expansion of the Border-to-Border Trail (B2B Trail) |

| Sen. Shink (D-Northfield Township) | $1M | Ann Arbor Treeline Conservancy Program | Construction along the northern portion of the Treeline in Ann Arbor |

| Sen. Shink (D-Northfield Township), Rep. Schmaltz (R-Jackson) | $750K | Jackson | Ella Sharp Park Trail improvements and bike library |

| Rep. Bruck (R-Erie) | $500K | Monroe | West Elm Avenue rail grade separation |

This year, all proposed supplemental earmarks – whether approved or not – were made public online for the first time. $120M was awarded from the General Fund to 98 total projects. For now, records are only searchable by date and legislator name, but with a little patience (and scripting) I was able to identify the projects above.

Legislatively Directed Spending Items: Michigan House

Legislatively Directed Spending Items: Michigan Senate

Other noteworthy additions

- The conference budget included a one-time earmark of $5.3M from the CTF for construction of non-motorized trails.

- The Road Usage Charge study and pilot, first discussed in 2023 and referenced in Governor Whitmer's budget recommendation earlier this year, was funded with $7.8M in one-time funds from the MTF and $171,900 yearly thereafter. The project is anticipated to last three years.

What's next?

Everyone who's played a role in educating our state lawmakers on the impact of transit investment should take a well-earned moment of rest! Reporters, all of you especially – endless thanks as always for being the boots on the ground through all the chaos a divided legislature brings.

In the meantime: Stay engaged on the local level. As with last year, providers across the state are seeking public input on service redesigns and expansions. I'll be sharing meetings as they're scheduled on the blog calendar , so be sure to follow along!

Jason Morgan

Jason Morgan

Zach Gorchow

Zach Gorchow